LTC Price Prediction: Technical Strength and Whale Activity Support Bullish Outlook

#LTC

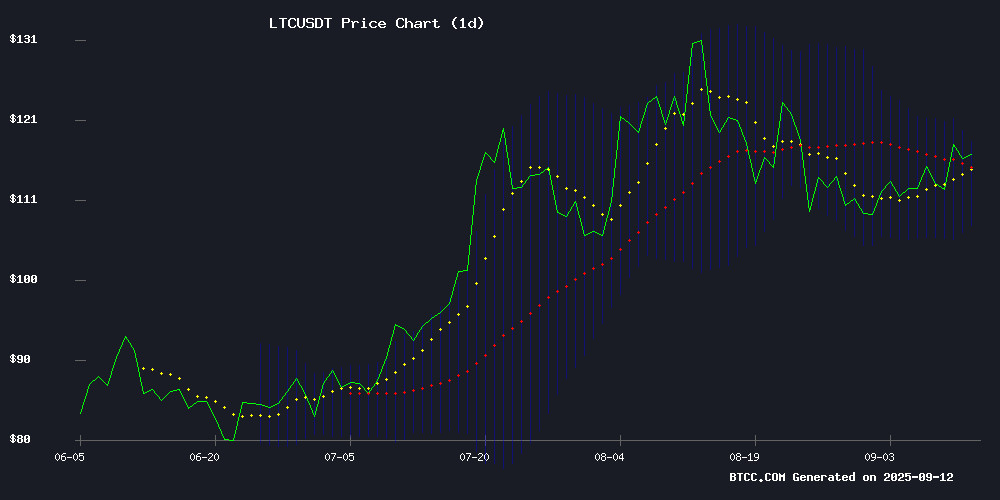

- LTC trades above 20-day moving average with positive MACD momentum indicating technical strength

- Whale accumulation of 181,000 LTC demonstrates substantial institutional support despite competitive pressures

- Bollinger Band positioning suggests near-term resistance at $117.96 with support at $107.41

LTC Price Prediction

Technical Analysis: LTC Shows Bullish Momentum Above Key Moving Average

Litecoin is currently trading at $115.68, positioned above its 20-day moving average of $112.6850, indicating underlying strength. The MACD reading of 0.9134 suggests building bullish momentum, though the negative histogram value of -2.2822 warrants caution. Price action NEAR the upper Bollinger Band at $117.96 suggests potential resistance, while support lies at $107.41. According to BTCC financial analyst Michael, 'LTC's ability to hold above the 20-day MA while MACD trends positive supports a cautiously optimistic near-term outlook.'

Market Sentiment: Whale Accumulation Offsets Mixed News Flow

Recent Litecoin whale activity showing accumulation of 181,000 LTC provides substantial underlying support despite mixed media coverage. While alternative coins like Layer Brett gain attention and Toncoin faces resistance, the substantial whale buying indicates institutional confidence. BTCC financial analyst Michael notes, 'Whale accumulation during price surges typically signals longer-term bullish conviction, though investors should monitor whether this buying pressure can overcome emerging competition and media narrative shifts.'

Factors Influencing LTC's Price

Litecoin Whales Accumulate 181,000 LTC Amid Price Surge

Litecoin's price has surged as on-chain data reveals significant accumulation by large holders. Santiment reports whales added 181,000 LTC (worth ~$114,300 per wallet) in a single day, signaling strong institutional interest.

The Supply Distribution metric shows addresses holding 1,000+ LTC rapidly expanding their positions. Such concentrated buying often precedes sustained upward momentum, as whale activity historically correlates with market trends.

Layer Brett Gains Media Spotlight as Top Crypto Pick Over Litecoin and Chainlink

Layer Brett ($LBRETT) is emerging as a standout in the crypto market, with global media outlets touting it as a superior investment to established assets like Litecoin (LTC) and chainlink (LINK). The project's presale, priced at $0.0055, has already raised $3.3 million, while its staking mechanism offers an eye-catching 782% APY. Built as an Ethereum Layer 2 solution, $LBRETT combines meme coin virality with tangible utility—delivering scalability, low fees, and DeFi integration. Analysts speculate 100x upside potential during the anticipated 2025 bull run.

Litecoin's recent momentum—fueled by ETF speculation and merchant adoption—pales in comparison to LAYER Brett's growth trajectory. As a mature asset, LTC faces market cap limitations, whereas $LBRETT's early-stage positioning and Layer 2 architecture create room for exponential gains. The project further streamlines onboarding through partnerships with MoonPay (enabling PayPal purchases) and Paxful x BitLipa for global access.

Chainlink, meanwhile, continues its institutional push with Grayscale's LINK ETF filing and CEO Sergey Nazarov's focus on tokenization. While these developments solidify LINK's role in traditional finance, Layer Brett distinguishes itself by converting meme-driven hype into sustainable on-chain activity. The altcoin's blend of viral appeal and technical infrastructure positions it as a unique contender in the evolving crypto landscape.

LTC Price Stagnates as Toncoin Faces Resistance; BlockDAG Emerges as Contender

Litecoin's price trajectory remains flat, with analysts noting limited upside potential due to constrained utility. Meanwhile, Toncoin struggles to break through key resistance levels despite its Telegram-backed adoption—raising questions about its long-term viability.

BlockDAG commands attention with 312,000 holders and 300+ dApps in development, positioning itself as an emerging ecosystem rather than a mere blockchain project. The platform's 4,500-strong developer base and presale momentum evoke comparisons to Ethereum's early growth phase, suggesting a replicable—and accelerated—path to network effects.

Is LTC a good investment?

Based on current technical indicators and market developments, LTC presents a compelling investment case with measured risk. The cryptocurrency trades above its key 20-day moving average while showing positive MACD momentum, indicating technical strength. Substantial whale accumulation of 181,000 LTC demonstrates institutional confidence despite emerging competition.

| Indicator | Value | Interpretation |

|---|---|---|

| Current Price | $115.68 | Above 20-day MA support |

| 20-day MA | $112.69 | Bullish positioning |

| MACD | 0.9134 | Positive momentum building |

| Bollinger Upper | $117.96 | Near-term resistance level |

| Whale Accumulation | 181,000 LTC | Strong institutional support |

While competition from newer projects creates headwinds, the combination of technical strength and substantial whale activity suggests LTC remains a viable investment for risk-tolerant portfolios.